Similar to other property types that are designed and built to operate as part of a small business, such as gas stations, car washes, funeral homes and hotels/motels, restaurants are a common property type that creates unique challenges for appraisers, tax assessors and lenders.

What makes these property types challenging for appraisers using traditional real estate appraisal techniques is that, unlike many traditional types of real estate, these small business properties sell as going concerns, with elements of personal property and often a business enterprise component. In other words, they sell as businesses that require the real estate that they are associated with, and the values of its components are intertwined with that real estate.

Additionally, in contrast to most traditional real estate assets, like office buildings and shopping centers, the income that supports the real estate for going concern properties is derived from business revenues, rather than from rent. It is the operating business that pays the mortgage and maintains the property.

“When the business and real estate are virtually inseparable, valuation approaches normally associated with business appraisal are likely to lead to a more reliable appraisal result”

Valuing Small Business & Professional Practices, authored by Shannon Pratt, and described as an authoritative guide and the premier reference book on the subject of small business valuation, notes: “Sometimes, the business and the real estate that it occupies are virtually inseparable, as in the case of a special-purpose property, for example. In these cases, the intertwined, or location-dependent, business will have more of the economic characteristics of a business entity than the economic characteristics normally associated with real estate. When the business and real estate are virtually inseparable, valuation approaches normally associated with business appraisal are likely to lead to a more reliable appraisal result than valuation approaches normally associated with the real estate appraisal.” The above would tend to suggest that an appraisal of the total real estate going concern, inclusive of all business assets, would provide the most reliable evidence of value.

However, there is a significant caveat to an appraisal that considers ONLY the going concern or business values that must be considered: it is also possible for the overall going concern value to be lower than the real estate value. “If the income generated by the business is less than the amount required to support the value of the assets, liquidation (closing the business and selling the assets) is the best course of action because it results in the highest value.” Appraisal of Real Estate, 14th Ed.

LIMITATIONS OF TRADITIONAL VALUATION APPROACHES

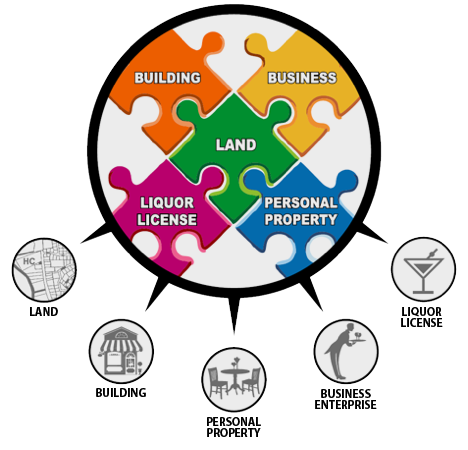

The need to isolate the value of the underlying real estate is widely recognized for lending purposes, tax assessment and in eminent domain cases. In applying the Market Approachby presenting recent sales of comparable properties, much of the available sale comparable data frequently includes sales of going concern properties and therefore included elements of personal property and business enterprise value. The result is often a value indication that is more accurately termed the Value of the Going Concern, or the Total Assets of the Business.

The traditional Income Approach also presents significant issues for real estate appraisers and tax assessors. Most small businesses operate based on margins and are managed by ratios of expenses to gross sales. The ability to remain profitable enough to stay in business depends on the ability to maintain costs at sustainable levels.

For restaurants, food and beverage costs can account for 30%-40% of gross sales, while salaries/wages typically account for 25%-35%. However, a combined cost of these two categories reaching 70% is often a “red flag”, since there are other expenses, including occupancy costs such as rent, utilities, insurance and building maintenance, as well as other costs such as marketing, credit card processing, music/entertainment, etc.

According to the National Restaurant Association, Income Before Income Taxes averages 6.1% and 6.6% for full service and limited service restaurants. Thus, profit margins are relatively narrow and provide little room for financial missteps.

As a result of the economic realities of these types of business oriented properties, economic rent is “sized for affordability” based on consideration of economic in addition to physical parameters. In other words, rental rates are more commonly and more reliably set based on explicit consideration of revenue. For restaurants, rent coverage ratios and rent-to-sales ratios are the common economic parameters that should be developed and analyzed.

These two metrics are not only important for understanding the affordability of the rent relative to the business, they are also crucial components to consider in untangling collection of values. In other words, they play important roles in assisting the appraiser to reliably and logically separate the component values of the real estate from the personal property and intangible assets.

Contrary to the more traditional use of lease comparables, economic rental rates for these properties tend to be more reliably based on explicit consideration of business volumes in addition to the physical aspects. These are long-standing practices designed to assure affordability as part of prudent underwriting. While lease comparables are useful as essentially a test of reasonableness, offering an alert when a prospective rental amount is unusual in a marketplace. Appraisals of restaurant properties should reflect the actions of buyers and sellers in that marketplace.

The cost approach often provides a useful benchmark within an appraisal; however, this approach has many shortcomings, including its inability to account for the business enterprise component. Additionally, as with many other property types, it is difficult to reliably estimate depreciation. And most importantly, it is not commonly relied upon by market participants.

THE NEED FOR A TOP-DOWN APPROACH

Authentically solving for the value of each of the individual components requires the understanding that the value of each must be satisfied from the total cash-flow. And that total cash-flow effectively represents the aggregate of multiple income streams attributable to each component, or factor of production.

The factors of production represent a hierarchy

The solution demands an approach more in line with the way that buyers and sellers view these properties in the marketplace – a top-down approach, coupled with traditional real estate appraisal techniques. This is in contrast to a bottom-up approach that would attempt to value each component and then to add those components together to derive the total value.

Such an approach would not be reflective of how buyers and sellers value these properties in the market place and would likely result in an unreliable value indication.

An important concept in the separation or allocation of values within the total going concern is recognition that the factors of production represent a hierarchy. This hierarchy can be displayed as a pyramid and signifies that all cash-flows generated by the property first must go to satisfy the basic needs of the land, followed by the building improvements, before flowing to support the return of and return on investment of the personal property, and ultimately to the business enterprise value.

Cash flow to the business enterprise component can only begin after the cash-flow requirements of the land, building improvements and personal property have been satisfied. Therefore, before a positive business value is created, the business must satisfy the requirement for a return of and return on investment for the investment in land, the building improvements and the personal property investment.

Therefore, intangible business value exists only to the extent that cash flows to the business exceed those required to support the tangible assets. As such, it is the riskiest component of value, and the first to decline or disappear when revenues decline. Which is one reason why appraising the business in isolation can sometimes lead to false results, in addition to the fact that appraising the real estate and business separately is often counter to the actions of the marketplace.

The Excess Earnings Method - A New Appraisal Tool

A tool to assist in overcoming the challenges faced by the traditional real estate appraisal techniques for these real estate-centered business enterprises emerged from a surprising source: an old business valuation technique that was developed by the US Treasury Department in 1920 to address the unique business valuation challenge posed at that time as a result of Prohibition. The valuation challenge at that time? To estimate lost intangible value suffered by breweries and distilleries as a result of the new legislation.

Fundamentally, this technique recognizes that each of the factors of production must be paid, and that each component can be valued by capitalizing the earnings that can be attributed to that asset. This technique was initially embraced by the business valuation community for many years, particularly for the appraisal of small businesses. However, its weakness for business valuations was the lack of empirical evidence to support many of the required assumptions. In contrast, with its application to real estate centered businesses, there is often adequate market data available to independently develop and reconcile the value conclusions using several additional metrics.

A 1997 Appraisal Journal article entitled “Defining and Allocating Going-Concern Value Components”, by T. Alvin Mobley III appears to have been the catalyst that brought this business valuation technique to the attention of the real estate appraisal industry, specifically as a tool to assist in solving the challenging valuation issues related to special purpose business oriented properties. Since that time, the premise of this technique has played a prominent role in a number of textbooks for the appraisal of a variety of special purpose properties, including golf courses, convenience stores and gas stations, and nursing facilities, as well as an influential article published in the Appraisal Journal’s Spring 2014 issue on “Restaurant Valuation”.

Thought leaders within the appraisal industry have largely accepted this approach as a “Best Practice” for the appraisal of special purpose properties like restaurants. In short, leading appraisers have come to recognize how the incorporation of this technique, often in conjunction with some of the traditional real estate appraisal approaches, is able to bridge that disconnect that had existed for so long.

Appraisal Standards

According to the Appraisal of Real Estate 14th Edition: “For some property types the real property rarely sells independently of personal property and intangible property. In those cases, establishing a reasonable allocation of the value opinion among the realty and non-realty components can be challenging.” Restaurants are one of those property types and frequently includes liquor licenses, personal property and intangible business assets.

“Business valuation and personal property valuation are distinct segments of the valuation profession, and those disciplines require substantial specialized education and experience that most real estate appraisers do not have.” “Even when an appraisal assignment involves valuing only real property, any allocation is an appraisal according to professional standards.” “In making an allocation, an appraiser must adhere to applicable professional standards. “Without additional specialized education, real estate appraisers are not generally competent to provide an opinion of the value of a business itself.”

“It is generally improper to value the real property, personal property, and intangible property separately from the going concern and simply sum up those individual values…” Simply stated, the sum of the values in exchange of the parts may not be equal to the value of the whole.

USPAP - Guide Note 5, effective May 6, 2011, recognized the unique challenges associated with special purpose properties like restaurants, and required the use of “accepted appraisal methods.”

Standards Rule 1-1: In developing a real property appraisal, an appraiser must be aware of, understand, and correctly employ those recognized methods and techniques that are necessary to produce a credible appraisal.” For restaurant valuation, the “recognized methods and techniques” frequently includes the Excess Earnings Method or some variant coupled with some of the more traditional valuation techniques.

Standards Rule 1-4(h): When personal property, trade fixtures, or intangible items are included in the appraisal, the appraiser must analyze the effect on value of such non-real property items.” The affect on value requires valuation knowledge of them.

Interagency Appraisal Guidelines - Effective December 10, 2010: It is often necessary to develop the going concern value or value-in-use, but the appraiser must have the training and knowledge to accurately allocate separate values to the individual components of the transaction.