The Challenge of Restaurant Appraisals

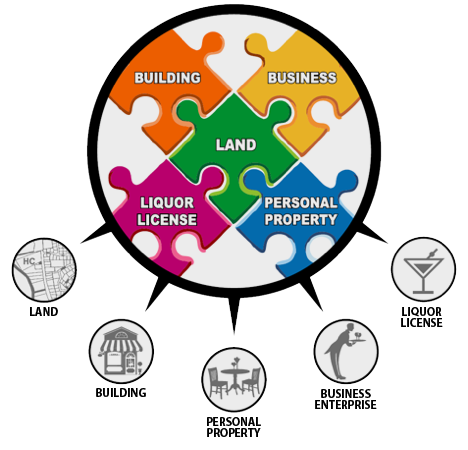

Separating real estate values from the business and personal property values.

“When the business and real estate are virtually inseparable, valuation approaches normally associated with business appraisal are likely to lead to a more reliable appraisal result”

Similar to other property types that are designed and built to operate as part of a small business, such as gas stations, car washes, funeral homes with crematoriums and hotels/motels, restaurants are a common property type that creates unique challenges for appraisers, tax assessors and lenders.

What makes these property types challenging for appraisers using traditional real estate appraisal techniques is that, unlike many traditional types of real estate, these small business properties sell as going concerns, with elements of personal property and often a business enterprise component. In other words, they sell as businesses that require the real estate that they are associated with, and the values of its components are intertwined with that real estate.

Additionally, in contrast to most traditional real estate assets, like office buildings and shopping centers, the income that supports the real estate for going concern properties is derived from business revenues, rather than from rent. It is the operating business that pays the mortgage and maintains the property.

Valuing Small Business & Professional Practices, authored by Shannon Pratt, and described as an authoritative guide and the premier reference book on the subject of small business valuation, notes: “Sometimes, the business and the real estate that it occupies are virtually inseparable, as in the case of a special-purpose property, for example. In these cases, the intertwined, or location-dependent, business will have more of the economic characteristics of a business entity than the economic characteristics normally associated with real estate. When the business and real estate are virtually inseparable, valuation approaches normally associated with business appraisal are likely to lead to a more reliable appraisal result than valuation approaches normally associated with the real estate appraisal.” The above would tend to suggest that an appraisal of the total real estate going concern, inclusive of all business assets, would provide the most reliable evidence of value.

However, there is a significant caveat to an appraisal that considers ONLY the going concern or business values that must be considered: it is also possible for the overall going concern value to be lower than the real estate value. “If the income generated by the business is less than the amount required to support the value of the assets, liquidation (closing the business and selling the assets) is the best course of action because it results in the highest value.” Appraisal of Real Estate, 14th Ed.