Lender Appraisals

“When personal property, trade fixtures, or intangible items are included in the appraisal, the appraiser must analyze the effect on value of such non-real property items.” How do you analyze the affect on value if you don’t know how to value those components?

Similar to other property types that are often designed and built to operate as part of a small business, such as gas stations, car washes, funeral homes with crematoriums and hotels/motels, restaurants are a common property type that creates unique challenges for appraisers and lenders.

In contrast to most traditional real estate assets, like office buildings and shopping centers, the income that supports the real estate for going concern properties is derived from business revenues, rather than from rent.

It is the operating business that pays the mortgage and maintains the property.

Additionally, because sales of operating properties often represent the sales of going concerns, inclusive of business assets beyond just the real estate, the sales comparison approach often cannot provide a reliable indication of real estate only values. Similarly, sales of non-operating properties commonly represent distress transactions, which can be equally misleading.

The solution to addressing this appraisal problem often demands an approach that begins with a perspective more in line with the way that buyers and sellers view these properties in the marketplace. This solution requires a top-down analysis that considers the income generating potential of the business. As a result, the most reliable approach to deriving the Fair Market Value is often to first solve for the Going Concern Value, followed by an accurate allocation of the contributory business assets.

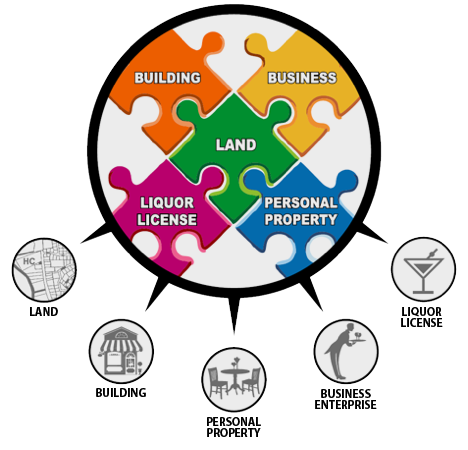

What makes these property types challenging for appraisers using traditional real estate appraisal techniques is that, unlike many traditional types of real estate, these small business properties sell as going concerns, with elements of personal property and often a business enterprise component. In other words, they sell as businesses that require the real estate that they are associated with, and the values of its components are intertwined with that real estate.

In practice, the integral processes of delineating a market, assessing demand, surveying the competitive supply, studying the relationship between supply and demand in the trade area, and tracking market trends serve as the underpinnings of the formal six-step process of market analysis and feasibility studies.

FIRREA: Requires that all appraisals be prepared in accordance with USPAP by individuals whose competency has been demonstrated.

USPAP requires: “appraisers must be aware of, understand, and correctly employ those recognized methods and techniques that are necessary to produce a credible appraisal.” For restaurant valuation, the “recognized methods and techniques” frequently includes the Excess Earnings Method or some variant, frequently coupled with some of the more traditional valuation techniques.

SBA Loans: Going Concern appraisals for Small Business Administration (SBA) Loans require appraisals to allocate separate values to the individual components of the transaction, including land, building, equipment and business. The SBA further requires appraisers to have adequate experience in a particular industry.

Interagency Guidelines apply to all institutions regulated by: Office of the Comptroller of the Currency; Board of Governors of the Federal Reserve System; Federal Deposit Insurance Corporation; Office of Thrift Supervision and the National Credit Union Administration.